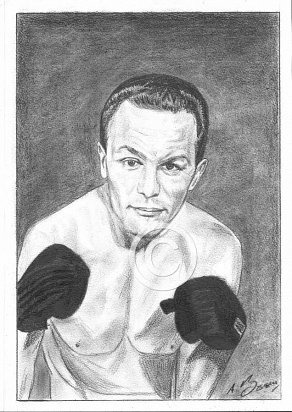

Henry Cooper

Pencil Portrait by Antonio Bosano.

Shopping Basket

The quality of the prints are at a much higher level compared to the image shown on the left.

Order

A3 Pencil Print-Price £45.00-Purchase

A4 Pencil Print-Price £30.00-Purchase

*Limited edition run of 250 prints only*

All Pencil Prints are printed on the finest Bockingford Somerset Velvet 255 gsm paper.

P&P is not included in the above prices.

Recommended listening

Desert Island Discs (16/5/66)

Recommended viewing

Henry Cooper v Brian London (12/1/59) British Heavyweight Title Fight

Henry Cooper v Muhammed Ali (June 18, 1963)

https://www.youtube.com/watch?v=Frn3rTj5DOY\

Henry Cooper v Muhammed Ali (21/5/66) World Heavyweight Title Fight

Cooper’s one and only World Title fight

https://www.youtube.com/watch?v=sXo0FqZaRUE\

Henry Cooper v Karl Mildenberger (18/9/68) - European Heavyweight Title Fight

Mildenberger had taken Ali to the 12th round in their ’66 World Title fight and was certainly no slouch. Cooper was 34 by this time, and bedevilled with right knee cartilage problems and a greengrocery business that was financially draining him. Committed to building a loyal clientele – this was a shop requiring ever increasing amounts of his time at the expense of other more lucrative promotional work – Cooper soon found himself working round the clock all week. Business was tough, despite the curiosity value associated with Our ‘Enry, and the move to Covent Garden never materialised. High weekly shop rates and the adverse effect of inclement weather on soft fruit bulk purchasing left Cooper with the need to buy wisely and sell quickly. The portents looked good with early rapid turnover, but profits were disproportionately offset by high wastage. Matters ran aground at Brentford, and with mounting debts and creditors on his back, Cooper pulled down the shutters on a £10,000 loss(circa £147,000 inflation adjusted), an embattled entrepreneurial failure but wiser man. Lessons learned would stand him in good stead when he took contract work with Brut in the 70\‘s.

Jabbing well, Cooper sussed out his southpaw adversary, boxing intelligently and amassing sufficient points, leaving his opponent with little option but to headbutt his way to an early termination on an illegal technicality. Judges had Cooper leading by four clear rounds and after 31 minutes, our man was once more European Heavyweight Champion.

This is your life (ITV 14/1/70)

“This is Your Life” was a British biographical television documentary, based on the 1952 American show of the same name. It was hosted by Eamonn Andrews from 1955 until 1964, and then from 1969 until his death in 1987 aged 64.

Michael Aspel then took up the role of host until the show ended in 2003. It returned in 2007 as a one-off special presented by Trevor McDonald, which to date was its most recent airing. In the show the host would surprise a special guest, before taking them through their life with the assistance of the ‘big red book.’ Both celebrities and non-celebrities were ‘victims’ of the show, which was originally broadcast live, and over its run it was syndicated on both the BBC and ITV.

Cooper’s appearance on the show occured on the day he signed a contract to fight Jack Bodell for the British Heavyweight Title. The pair would meet at Wembley on March 24, for a punishing and bruising encounter which went the full 15 round distance. Whilst neither fighter was able to land that all important knock-out blow, the judges would award the points decision in favour of Cooper.

On the show itself, Henry is joined by his beloved wife Albina, his father and two brothers (his mother was convalescing with flu.) The couple’s two boys appear on pre-recorded video, and Muhammed Ali contributes a heartfelt tribute by video from the states. It’s all rather quaint, and respectful, and a programme that belongs to a different age. That was Henry though, a true sportsman and a gentleman.

Recommended reading

An autobiography from Henry Cooper (1972)

I was interested to pick up an original hard bound edition of Cooper’s autobiography, first published in 1972, just after his retirement from the ring.

It’s a wonderfully evocative retelling of his professional life, his courtship with Albina and his business hopes for the future. In effect it reads as part one of his life, no less compromised by the intervening years since its original publication, than the reader’s knowledge of what was to come.

Comments

When Henry Cooper died in 2011 at the age of 76, three-time world heavyweight champion Muhammed Ali spoke of his sadness at his old adversary’s death:

‘I am at a loss for words over the death of my friend, Henry Cooper. I was not aware he was ill. I visited with him two summers ago during a brief visit to Windsor as part of the Equestrian Games being held there. He was in good humour and looked quite fit.’

A much loved sportsman, Our ’Enery had endured some difficult and sad times in his later years, not least the sudden death of Lady Albina, his Italian-born wife of 47 years in 2008. The loss of his twin brother George, his ringside aide throughout his boxing career, was another huge blow.

Under construction

In 1993, Henry was compelled to sell his three Lonsdale Belts at Sotheby\‘s sale of sporting memorabilia, held at the Kent County Cricket Club’s ground in Canterbury. The complete collection was purchased for £42,000 – some £28,000 short of the former boxer’s expectations – by an unnamed telephone buyer, believed to be a 44-year-old man from Kent who worked in the music business. Cooper did in fact attend the bidding, in order to sell the belts, each earned by successfully defending his British title three times, after losing heavily on Lloyd’s insurance market.

Speaking at the time, he said he was not disappointed at the amount raised. ‘I am happy enough that they are staying together,’ was his considered response to a reporter\‘s question.

The first of the belts to go was the oldest and the only one made of gold. It was made in 1936 and won for the first time the following year by Tommy Farr. It was won outright by Henry in 1959 after he defeated Brian London on points at Earl’s Court Stadium. It was sold for £22,000. The other two, won in 1964 and 1967, went for £10,000 each. Cooper, undefeated British champion for 11 years from 1959, remains the only boxer at any weight to have won three Lonsdale Belts outright.

I first became seriously aware of Lloyds and its modus operandi, when I began studying for my first Chartered Insurance Institute exams in the early 80’s. Lloyd’s had its roots in Mr Edward Lloyd’s coffee shop in 17th century London. The market was incorporated by an Act of Parliament in 1871, and it was part of the old City establishment – a blue-blooded establishment where the underwriters came from a common background and knew each other and each other’s families. The market functioned to a huge extent on trust – and, by and large, the system worked. The most distinctive feature of the market was that it drew its capital from external sleeping partners – the ‘Names’ – who put up some of their assets for investment at the price of accepting unlimited liability for any losses. This is the “ultimate risk” of the book’s title. A false sense of security was created for many years, as the offbeat arrangement functioned well for nearly all of the Names virtually the entire time. There were occasional losses and scandals, but the surprising thing was not that such events occurred but rather how uncommon they were.

The first danger signs surfaced in the 1960s. A series of misfortunes – notably Hurricane Betsy, which hit the United States in 1965 – led to uncomfortable losses. The number of new members began drying up, and existing ‘Names’ resigned. In 1969, a report was commissioned from Lord Cromer, a former Governor of the Bank of England (1961-66). Cromer pointed to the conflicts of interest inherent in the system, and stated frankly that the market was in need of major reform. This wasn’t what the old guard wanted to hear, and the report was largely shelved. Its contents wouldn’t become public knowledge for another 20 years.

In one respect, however, Cromer’s recommendations were implemented, and it became a lot easier to invest in Lloyd’s. Before Cromer, a ‘Name’ had to have

(1) assets of £75,000, and

(2) a deposit of £35,000

This would permit him to underwrite business worth £180,000.

After Cromer’s recommendations, a ‘Name’ had to have

(1) assets of only £50,000, and

(2) a deposit of £35,000.

This now allowed him to take on business worth £350,000.

Individuals like Henry Cooper were doomed when a separate class of ‘mini-Names’ was also created: these needed assets of only £37,500. Whilst this financial holding excluded the family home, it was possible for ‘mini-names’ to put forward a bank guarantee secured against it. Moreover, any assets deposited with Lloyd’s would carry on earning money: shares, for example, would continue (hopefully) to rise in value and to pay dividends. It should also be said that the tax regime maintained by the Labour governments of the 1970s created unwitting incentives to invest in the insurance market.

There was traditionally, considerable prestige involved in becoming a Lloyds member. As a child, I was forever seeing photographs of celebrities dressed “to the nines” like city toffs in their pinstripe suits, bowler hats and brollies being welcomed as a ‘name’. There was considerable publicity for Lloyds in 1965, when several syndicates insured each of The Beatles for the sum of £1m before they embarked on their third US tour. These individuals were amalgamated into many different syndicates, each comprised from a few to several hundred members. The syndicates were represented at Lloyd’s by underwriting agents, who accepted insurance business on behalf of syndicate members. The syndicate system, which was developed to handle the greatly increased insured values of the 20th century, created a means of spreading an insurance risk over a number of individuals.

When a claim is made, each underwriter is responsible only for his portion. Syndicate members who did not underwrite personally became known as “names.” Traditionally, names had unlimited personal liability for the business transacted for them by their underwriting agents. This policy was modified after thousands of names were bankrupted by record losses in the late 1980s and early ’90s, many of which stemmed from pollution and asbestos claims. Lloyd’s had withheld their knowledge of asbestosis and pollution claims until they could recruit more investors to take on these liabilities that were unknown to investors prior to investing in Lloyd’s. Enforcement officials in 11 US states charged Lloyd’s and some of its associates with various wrong doings such as fraud and selling unregistered securities; Ian Posgate, one of Lloyd’s leading underwriters and its deputy chairman, was charged with skimming money from investors and secretly trying to buy a Swiss bank; he was later acquitted.

Eventually, changes would be introduced to limit losses to 80 percent of a name’s total permitted annual premium income over a period of four years. Losses exceeding the limit would be paid from a pool funded by an annual levy on all names. In 1993, Lloyd’s voted to allow corporate and institutional investors to participate in its underwriting business for the first time. Eventually, the number of names dropped from more than 30,000 to fewer than 10,000. Henry Cooper would be amongst the casualties.