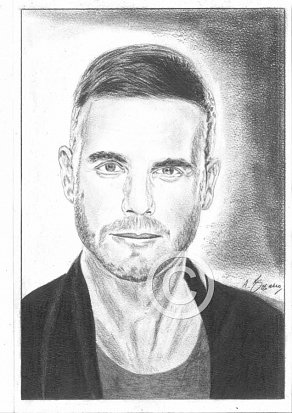

Gary Barlow

Pencil Portrait by Antonio Bosano.

Shopping Basket

The quality of the prints are at a much higher level compared to the image shown on the left.

Order

A3 Pencil Print-Price £20.00-Purchase

A4 Pencil Print-Price £15.00-Purchase

*Limited edition run of 250 prints only*

All Pencil Prints are printed on the finest Bockingford Somerset Velvet 255 gsm paper.

P&P is not included in the above prices.

Comments

Last update :14/5/14

There’s something uniquely indigenous to the British psyche – we love knocking our home grown stars off their pedestals. As a five time Ivor Novello award winning songwriter, Gary Barlow is nonetheless often criticised for his lack of quality control when donating material to other artists. The accusation that he holds back the best material for his own albums has some merit, but is not a universal rule of thumb. ‘This Time,’ his compositional gift to Dame Shirley Bassey for her 2009 album ‘The Performance’, was a wonderful construction with an emotive use of the sixth chord..

He’s successful, as £38m in the bank amply testifies, and has been at the forefront of British pop for twenty years, as a member as Take That, a chart topping solo star and as an X Factor judge. In the summer of 2012, he was the musical director at the Queen’s Diamond Jubilee Concert, a worldwide televised event that sealed his stamp of approval with both Royalty and the music industry. All therefore seemed well, yet within weeks tragedy would strike when his fourth child was delivered stillborn. Here was an event so emotionally gut wrenching that he would have handed back all the money in order to change events. Certain events often refocus our minds on what is truly important in life. In a statement issued to the press, Gary was moved to say:

“Poppy Barlow was delivered stillborn on August 4th in London. Our focus now is giving her a beautiful funeral and loving our three children with all our hearts. We’d ask at this painful time that our privacy be respected.”

Under construction

In May 2014, Barlow would find himself in hot water over his involvement in a tax avoidance scheme – various hyperventilating Members of Parliament, journalists and members of the public, calling for the rescinding of his OBE, as a result of the disclosure. HMRC had won a landmark case in which the ‘Icebreaker Partnership’ schemes were shut down, after a first tier tax tribunal had ruled it was set up solely to shelter more than £130m in tax.

Around £336m was invested into the scheme, which was developed by the entertainment firm Icebreaker Management, and adopted by 51 partnerships. The scheme purported to find finance for creative projects within the music industry and offer a return for investors, but in fact generated losses. Included in the investors were Barlow himself, and two of his Take That bandmates, Howard Donald and Mark Owen. The band’s manager, Jonathan Wilde, was also involved in investing more than £66m into partnership Larkdale LLP.

As far as the law was concerned, Barlow and co had not done anything wrong in a criminal sense. Nevertheless,

even though tax avoidance is normally legal, it can quite easily turn into tax evasion – and tax evasion, a deliberate plan to cheat the taxman, is most definitely an offence.

Tax avoidance schemes are legal arrangements put in place to mitigate tax liabilities. They can apply to both companies and individuals. More importantly, and a lesson for all participants involved, the fact that a scheme has been disclosed and given a reference number simply means that the promoter has complied with their obligations under the disclosure of tax avoidance schemes (DOTAS), and not that the scheme has been approved by HMRC.

By way of example, a lot of schemes in recent years have involved companies using employees’ benefit trusts (EBTs), which are designed to reduce income tax and national insurance on salaries to directors and employees and to reduce company profits. The net result is that the company pays less corporation tax. A Discretionary Trust is set up with offshore trustees, and the company pays a contribution on behalf of an employee to the Trust. This enables the employee to avoid paying tax or a National Insurance Contribution (NIC) whilst the company receives tax relief on the remuneration paid. The contributions are then taken out at a later date when it is tax advantageous.

Another example is when individuals make investments through film partnerships, via their own income and loans. They then claim ‘sideways’ tax relief on the investment (essentially offsetting losses against other taxable income), to trigger a repayment of tax.

In situations such as these, HMRC always opens an enquiry automatically into an individual who, or a company which, has invested into a tax avoidance scheme. Whilst the enquiry may take years to conclude, the inescapable fact remains that should the scheme be unsuccessful, then HMRC will demand all the tax back plus penalty interest that has been saved by the ‘arrangement’.

It should be noted that while tax evasion is illegal, tax avoidance is not a criminal activity. However, various anti-avoidance rules exist to stop tax avoidance where the avoidance is clearly the only motive behind a transaction or series of transactions.

For those quick to deplore the actions of certain scheme investors, let us remind ourselves that a disproportionate amount of income tax is paid by a small percentage of the UK workforce. At the top end of this group of high earners, it would be quite reasonable to presume a sense of resentment at paying more than their share, incredulity at a level of taxation beyond any possible benefit, and an equally reasonable desire to hang on to as much of their hard earned cash as legally possible.

Barlow, by his own admission, has never been particularly ‘orderly’ with his earnings and presumably, merely responded enthusiastically to his adviser’s overtures about a tax saving scheme that at face value, appeared legal. He is not a tax expert, and when the Icebreaker news broke, the degree of sanctimonious whining from left of stage was excessive. There appeared little chance of the singer refusing to pay HMRC – on the contrary, early press reports would hint at a Take That autumn 2014 tour to recoup ‘losses’.

The UK Government has, in effect, a five pronged approach to combating aggressive tax avoidance, namely;

(1) Legislation: specifically through the use of targeted anti-avoidance rules

(2) Litigation: as evidenced by attacks on the Icebreaker and Eclipse schemes.

(3) The General Anti Abuse Rule (GAAR)

(4) The Disclosure Of Tax Avoidance Schemes (DOTAS) provisions (effectively an early warning system)

(5)Publicity, in the shape of “naming and shaming”, to keep public opinion firmly on the side of combating tax avoidance and being seen to be acting to prevent abuse – such publicity as that given to the involvement of several high profile personalities in aggressive tax avoidance

This multi-faceted approach appears to be working and it will be interesting to see what effect it is having on helping to close the “tax gap” which stands at over £30 billion (2014). The gap is substantially contributed to by evasion and crime but avoidance and “legal interpretation” contributes an estimated 20% plus to this figure and it is this “contributor” that is effectively being targeted by the five pronged strategy summarised above.